Building trusted markets for all participants

Cboe Australia (CXA) launches new functionality to support client demand and to support the launch of Cboe Australia's Corporate Listing function in the second half of 2025.

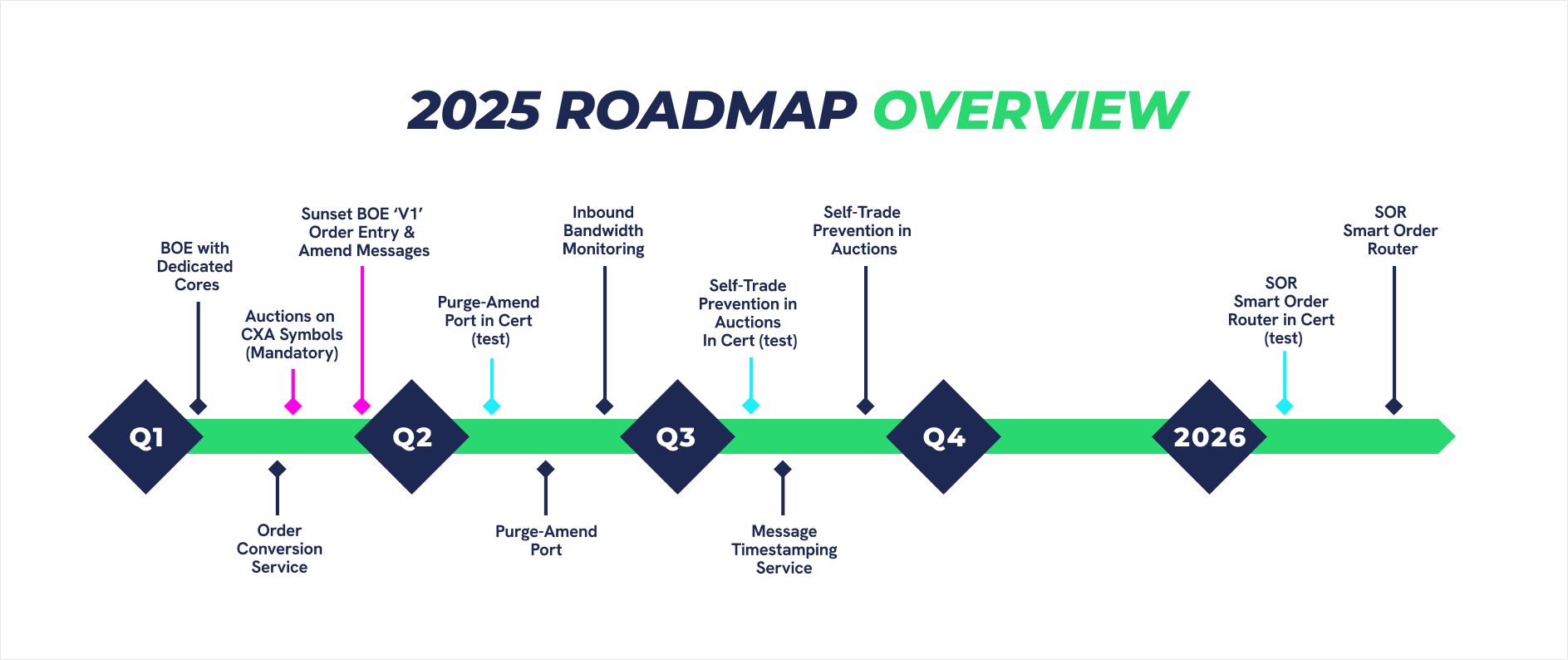

Below is a detailed timeline for key functionalities launching in 2025 and beyond:

| Functionality | Mandatory or Optional | Cert(Test) |

Production

Dates marked (*) will be clarified in forthcoming Technical Notices |

|---|---|---|---|

| BOE with Dedicated Cores is an additional option for BOE clients to achieve greater certainty with ~25% reduced internal latency. | Optional | n/a | 20-Jan-2025 |

| Order Conversion Service (OCS) allows participants to instruct Cboe systems to apply pre-defined order conversions on their behalf, without the need for participant development effort. The first instance of OCS will include the option to convert incoming Pegged IOC orders into Pegged GTD orders with a sub-second expiration. | Optional | 17-Feb-2025 |

4-Mar-2025

|

| Auctions on CXA symbols will be introduced for opening and closing liquidity events on CXA Funds and as part of the planned launch of a corporate listing function for CXA. | Mandatory | 18-Nov-2024 | 17-Mar-2025 |

| Retirement of V1 BOE Messages concludes the 6 - 9 month period where participants can migrate their BOE applications from V1 to V2 messages to suit their own schedule. | Sunset Date | Same date as Production | 31-Mar-2025 |

| Purge-Amend Port extends the existing Purge Port functionality to facilitate the amendment of orders that were entered by any order entry port across your firm. | Optional | 14-Apr-2025 | 19-May-2025 |

| Inbound Bandwidth Monitoring is a system protection which disables a 10Gb physical port if incoming messages exceed 5Gbps, far exceeding normal operation bandwidth. | No impact | n/a | 24-May-2025 |

| Message Timestamping Service provides end-of-day reports with insights into participant's order entry, amend and cancel messages throughout Cboe's exchange infrastructure. | Optional | n/a | *Q3-2025 |

| Self-Trade Prevention in CXA Auctions will include the Booking Purpose outcome to align with AU market requirements. | No impact | *Jul-2025 | *Aug-2025 |

| Smart Order Router (SOR) related mechanisms to facilitate external SOR requirements. | tbd | *2026 |

*2026

|

Cboe is aware of potential impacts on clients and the resource contention with other priorities throughout the APAC region. The information provided here can be used by clients to plan for proposed and scheduled technology releases. Where go-live dates have not been confirmed, customers will be notified of dates, once finalised, by way of Cboe notices published to the market.

Cboe makes every effort to minimize the impact of changes and provides optionality where possible.

Cboe makes every effort to minimize the impact of changes and provides optionality where possible. Cboe is aware of potential impacts on clients and the resource contention with other priorities throughout the APAC region. The information provided here can be used by clients to plan for proposed and scheduled technology releases. Where go-live dates have not been confirmed, customers will be notified of dates, once finalized, by way of Cboe notices published to the market.

| Functionality |

Order Entry FIX, BOE, |

Private Feeds |

Market Data Feeds TOP, |

|---|---|---|---|

| BOE with Dedicated Cores is an additional option for BOE clients to achieve greater certainty with ~25% reduced internal latency. |

No change. Uses same BOE messages. New connectivity details for new logical ports as per usual. |

n/a | n/a |

|

Order Convesion Service instructs Cboe systems to apply pre-defined Cboe instructions, which have been requested by a participant, to be applied to certain orders under certain conditions on their behalf, without the need for participant development effort. The first instance of the Order Conversion service will include the option to convert incoming Pegged IOC orders into Pegged Day orders with a sub-second expiration, thus increasing execution opportunities. |

No change. Port Attribute driven. |

n/a | Existing Trade Message's 'reserved field' to include an indicator for 'converted order' executions. |

| Auctions on CXA symbols will be introduced for opening and closing liquidity events on CXA Funds and as part of the planned launch of a corporate listing function for CXA. | Indicator if your trade originated from an auction in existing FIX tag TradeLiquidityIndicator and BOE field BaseLiquidityIndicator. | Indicator if your trade originated from an auction in existing tag TradeLiquidityIndicator. |

Mandatory updates: Existing Trading Status message to include new PreOpen / Pre-Close trading phases. PITCH: New Order Executed at Price message when a lit order is executed in an Auction. TOP: Existing TOP Trade message to include indicator if a trade resulted from an auction. New Auction Update message to provide, preauction, the indicative auction price and volume for a symbol. New Auction Summary message to provide auction price and total volume traded in the auction for a symbol. CXATSL / CXALSL: Additional fields to indicate if a symbol is eligible for Auctions and fields related to corporate actions in anticipation of the launch of Cboe listings later in 2025. |

| Retirement of V1 BOE Messages concludes the 6 - 9 month period where participants can migrate their BOE applications from V1 to V2 messages to suit their own schedule. |

BOE: Sunset of legacy V1 New order and Modify order messages:

|

n/a | n/a |

| Purge-Amend Port extends the existing Purge Port functionality to facilitate the amendment of orders that were entered by any order entry port throughout your firm. Updates to the FIX spec are temporarily hightlighted in purple font for clarity. | Existing Purge Ports will include the added functionality to amend orders entered throughout a firm. | n/a | n/a |

| Message Timestamping Service provides end-of-day reports with insights into participant's order messages throughout Cboe's exchange infrastructure. | n/a | n/a | n/a |

| Inbound Bandwodth Monitoring is a system protection which disables a 10Gb physical port if incoming messages exceed 5Gbps, far exceeding normal operation bandwidth usage. | n/a | n/a | n/a |

| Self-Trade Prevention in Auctions will include the Booking Purpose outcome to align with AU market requirements. | n/a | n/a | n/a |

| Smart Order Router (SOR) related mechanisms to facilitate external SOR requirements. | Inclusion of optional SOR details. | tbd - optional | tbd - optional |

For more information contact the Cboe Trade Desk at [email protected] or call 02 8078 1701.