Equities Market Research

Trending

Market Metrics That Matter: Your Monthly Canadian Cash Equities Volume Briefing

Canadian volumes remain strong at 1.18 billion Average Daily Volume (ADV), down 0.15% month-over-month but up 27% year-over-year. Cboe Canada market share is stable at 12.6%.

Read MoreAugust Highlights

- Canadian volumes remain strong at 1.18 billion Average Daily Volume (ADV), down 0.15% month-over-month but up 27% year-over-year

- Cboe Canada market share is stable at 12.6%

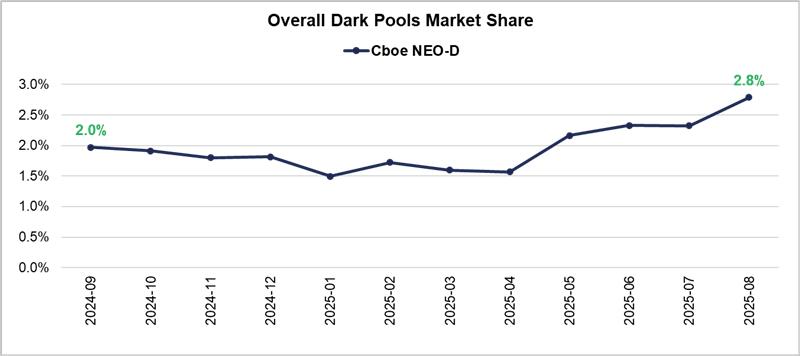

- NEO-D market share increased to approximately 0.2% overall market share and 2.8% of all dark pools

- NEO-D is the only dark marketplace in Canada that provides an active rebate to retail with price improvement.

- NEO-D has a strict price-time priority model with no broker preferencing.

- NEO-D active volume is over 56% retail.

Source: TMX Information Processor

Upcoming Changes

September 30, 2025: Cboe Canada plans to roll out visible Primary Peg order type

October 27, 2025: Cboe Canada plans to update hours of operation for pre-open session to 7:00 a.m. - 9:30 a.m. on NEO-D and MATCHNow

Recent Events

- We enjoyed connecting with industry colleagues and discussing current trends and challenges at this year’s Canadian Securities Traders Association (CSTA) conference. In addition to insights gained through the conference, our North American Equities team enjoyed hosting attendees for an exciting whitewater rafting adventure on the Ottawa River.

News and Insights

- Index Insights: August

- The ETF Shift That’s Reshaping Investor Strategy

- How Outcome Based ETFs Are Reshaping Investor Demand

New Listings

Ten Purpose Canadian Yield Shares ETFs offer targeted exposure and consistent income potential:

- Purpose RBC (RY) Yield Shares ETF (RBCY)

- Purpose Enbridge (ENB) Yield Shares ETF (ENBY)

- Purpose TD (TD) Yield Shares ETF (TDY)

- Purpose Shopify (SHOP) Yield Shares ETF (SHPY)

- Purpose Canadian Natural Resources (CNQ) Yield Shares ETF (CNQY)

- Purpose Scotiabank (BNS) Yield Shares ETF (BNSY)

- Purpose Dollarama (DOL) Yield Shares ETF (DOLY)

- Purpose Telus (T) Yield Shares ETF (TY)

- Purpose Couche-Tard (ATD) Yield Shares ETF (ATDY)

- Purpose Brookfield (BN) Yield Shares ETF (BNY)

Four new BetaPro ETFs from Global X:

- BetaPro 3x Semiconductor Daily Leveraged Bull Alternative ETF (SOXL)

- BetaPro -3x Semiconductor Daily Leveraged Bear Alternative ETF (SOXS)

- BetaPro 3x US Treasury 20+ Year Daily Leveraged Bull Alternative ETF (TTLT)

- BetaPro -3x US Treasury 20+ Year Daily Leveraged Bear Alternative ETF (STLT)

Two new index tracking ETFs from Franklin Templeton:

The information herein is provided solely for informational purposes. Past performance of an index or financial product is not indicative of future results. Indices are not financial products that can be invested in directly, but they can be used as the basis for financial products (for example, without limitation, options, futures, mutual funds or exchange-traded funds) or to help manage portfolios. Nothing herein should be construed as investment advice

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products are complex and are suitable only for sophisticated market participants. In certain jurisdictions, Cboe Company products are only permitted for investment professionals, certified sophisticated investors, or high net worth corporations and associations. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 Cboe Exchange, Inc. All Rights Reserved.