Data Analytics and Indices

Trending

Discover the Cboe Magnificent 10 Index: Targeted Exposure to U.S. Growth and Tech-Focused Leaders

The Cboe Magnificent 10 Index is your gateway to the performance of 10 tech and growth-oriented U.S.-listed companies. This equal-weighted index is designed to capture the growth of large cap stocks shaping the future of the global economy.

Read MoreThe Cboe Magnificent 10 Index is your gateway to the performance of 10 tech and growth-oriented U.S.-listed companies. This equal-weighted index is designed to capture the growth of large cap stocks shaping the future of the global economy. The value of the MGTN Index will be available on the Cboe Global Indices Feed via the Cboe Global Indices Channel. The index includes:

- NVIDIA Corporation — NVDA

- Apple Inc. — AAPL

- Amazon.com, Inc. — AMZN

- Alphabet Inc. (Google) — GOOGL (Class A)

- Microsoft Corporation — MSFT

- Meta Platforms, Inc. (Facebook) — META

- Tesla, Inc. — TSLA

- Advanced Micro Devices, Inc. (AMD) — AMD

- Broadcom Inc. — AVGO

- Palantir Technologies Inc. — PLTR

Why the Cboe Magnificent 10 Index?

- Market Leadership: Constituents are selected for their dominance in technology, consumer trends, and business services.

- Innovation Focus: Companies have been selected based on liquidity, market value, trading volume and leadership in areas like artificial intelligence and digital transformation.

- Fixed Constituents: At launch, the index includes 10 companies at once including NVDA, AAPL, AMZN, GOOGL, MSFT, META, TSLA, AMD, AVGO, and PLTR .*

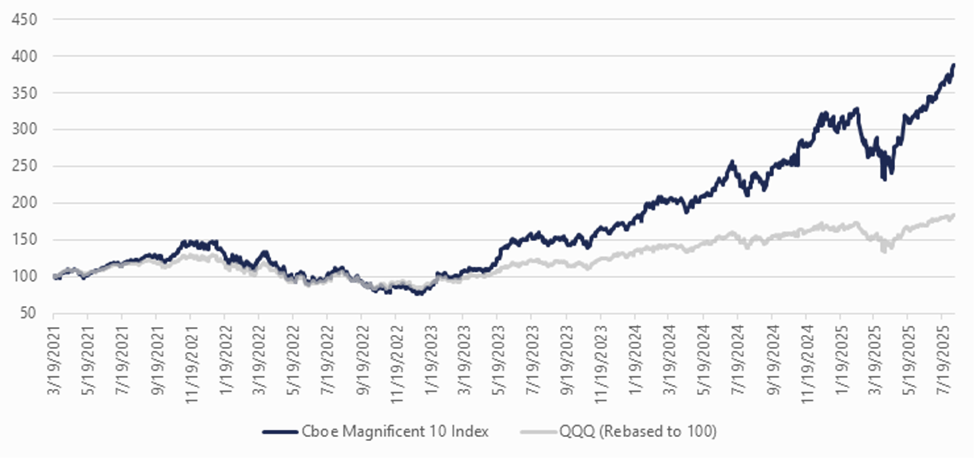

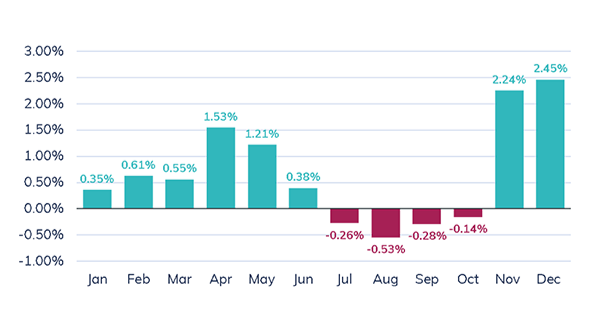

Hypothetical Back-tested Index Performance

Source: September 2025 Cboe Global Markets and Refinitiv. 3/19/2021 – 8/11/2025; Daily return correlation: 0.96. For periods prior to index launch date, any charts may include back-tested data. Past performance is not predictive of future returns.

The chart highlights the daily return performance of the Cboe Magnificent 10 Index versus the QQQ ETF, showcasing a strong directional alignment over time.

This close tracking underscores the index’s relevance for investors seeking diversified exposure to leading tech and growth-oriented companies.

Key Takeaways

- Strong Correlation (0.96): The Cboe Magnificent 10 Index has demonstrated a high degree of co-movement with the QQQ ETF, reflecting its exposure to similar market drivers like AI, cloud computing, and digital innovation.

- Historical Back-Test Period: Covers over four years of market data, including periods of heightened volatility, such as post-pandemic recovery, inflationary pressures, and AI-driven growth cycles.

- Equal Weighting Advantage: Unlike market-cap-weighted indices, the Cboe Magnificent 10 Index gives each constituent equal influence, helping mitigate concentration risk and offering a more balanced approach to tech and growth-orientated exposure.

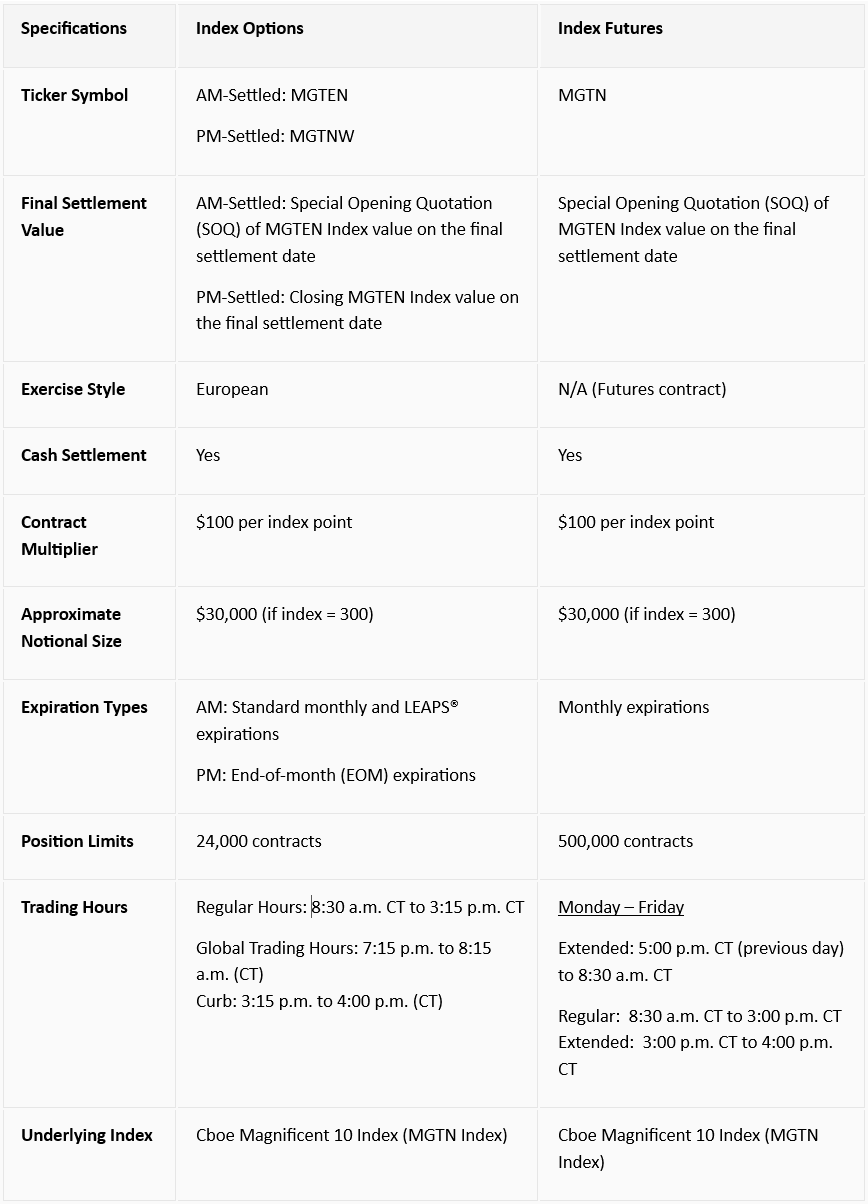

Product Suite: Options and Futures

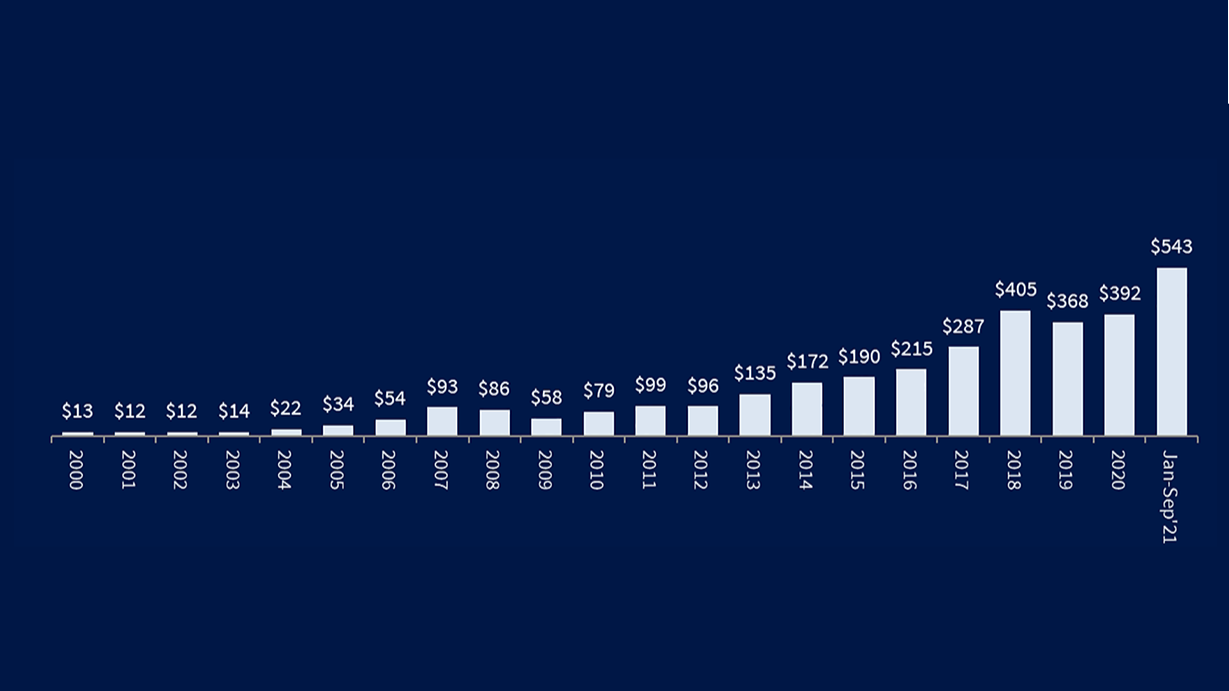

Thematic investing is growing, with global assets in thematic ETFs climbing from under $50 billion a decade ago to more than $200 billion today. Traders are increasingly drawn to powerful market narratives — AI, EVs, digital transformation — and the Cboe Magnificent 10 Index sits squarely at the center of this momentum.

To meet this demand, Cboe plans to launch a suite of futures and options based on the Cboe Magnificent 10 Index (MGTEN) in Q4 2025, pending regulatory review. These cash-settled products will offer targeted exposure to growth-oriented and tech stocks, empowering investors to trade innovation with precision and flexibility.

Who Should Consider Cboe Magnificent 10 Index Products?

- Active Traders & Self-Directed Investors: Seeking targeted, thematic exposure to U.S. tech leaders.

- Financial Advisors & RIAs: Managing tactical allocations for high-net-worth and retail clients.

- Pro-Retail Platforms & Digital Wealth Managers: Offering innovative, growth-oriented products.

- ETF & Structured Product Issuers: Building retail-friendly, index-linked solutions.

- Global Investors: Accessing U.S. innovation and growth with efficient, cash-settled products.

Key Benefits

- Diversified Tech Exposure: Capture the collective performance of 10 industry leaders in a single trade.

- Margin Efficiency: Especially with futures, optimize capital usage for tactical or strategic positions.

- Flexible Trading: Multiple expirations and trading hours to fit your strategy and schedule.

- Transparent & Regulated: Options listed on Cboe Exchange, Inc. (Cboe Options) and futures listed on Cboe Futures Exchange, LLC (CFE), subject to regulatory oversight.

Resources

Benefits of Index Options Guide

The Options Institute webinars

<iframe src='https://go.cboe.com/l/77532/2025-08-29/fnl28d' width="800" height="1600" type="text/html" frameborder="0" allowTransparency="true" style="border: 0"></iframe>

Disclosures

*Subject to change per the index methodology.

There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here.

Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers. These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle.

This information is a high-level overview of what is currently contemplated. The information included is subject to change and to more detailed provisions that would be put in place in connection with the planned launch of Cboe Magnificent 10 Index futures. Additionally, the planned launch of Cboe Magnificent 10 Index futures remains subject to regulatory review.

This information is provided for general education and information purposes only. No statement provided should be construed as a recommendation to buy or sell a security, future, option on a future, security future, digital asset, financial instrument, investment fund, or other investment product (collectively, a “financial product”), or to provide investment advice.

Trading in futures and options on futures is not suitable for all market participants and involves the risk of loss, which can be substantial and can exceed the amount of money deposited for a futures or options on futures position. You should, therefore, carefully consider whether trading in futures and options on futures is suitable for you in light of your circumstances and financial resources. You should put at risk only funds that you can afford to lose without affecting your lifestyle. For additional information regarding the risks associated with trading futures and options on futures and with trading security futures, see respectively the Risk Disclosure Statement Referenced in CFTC Letter 16-82. and the Risk Disclosure Statement for Security Futures Contracts. Certain risks associated with options, futures, and options on futures and certain disclosures relating to information provided regarding these products are also highlighted at https://www.cboe.com/us_disclaimers/.

Hypothetical scenarios are provided for illustrative purposes only. The actual performance of financial products can differ significantly from the performance of a hypothetical scenario due to execution timing, market disruptions, lack of liquidity, brokerage expenses, transaction costs, tax consequences, and other considerations that may not be applicable to the hypothetical scenario.