Trending

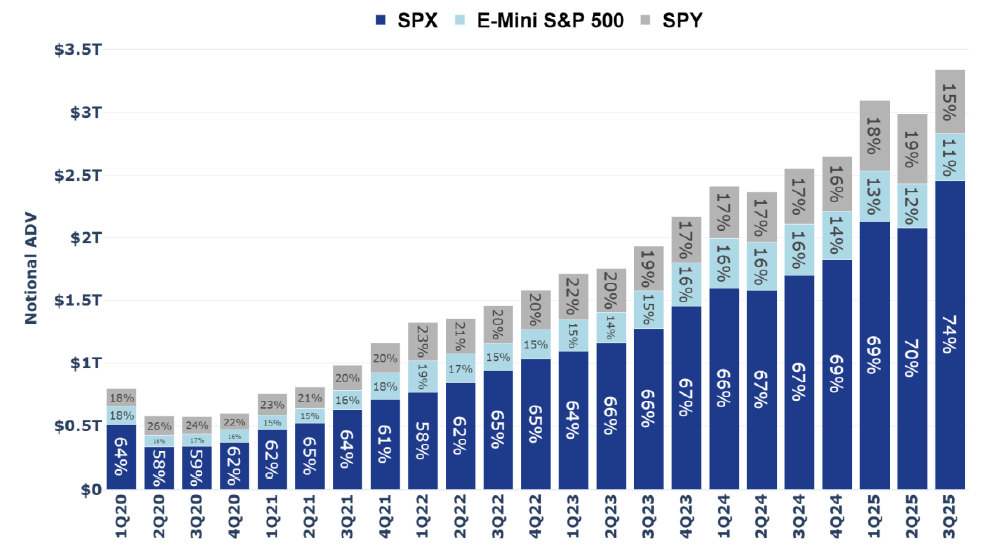

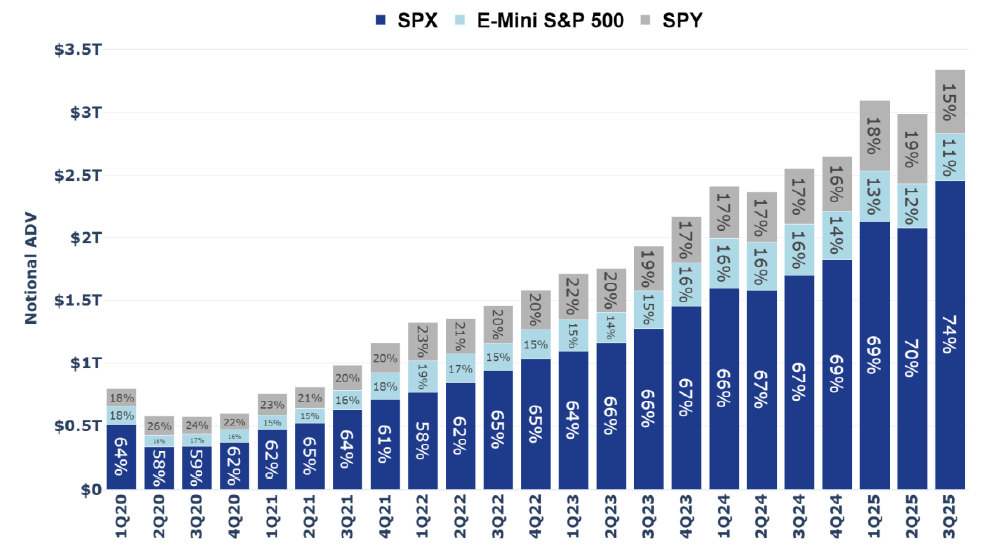

SPX® Options Jump to Record 74% Market Share

Implied volatilities were mixed across asset classes last week as the US government shut down for the first time since 2018. Interest rate volatility declined meaningfully, with the VIXTLT Index falling to a 1-year low while the MOVE Index collapsed to a 3-year low. In contrast, equity volatility gained last week, with the VIX® index increasing 1.4 pts to 16.7%. This is despite realized volatility grinding to a 1-year low of 5.9%. SPX 1M implied-realized spread widened to the 99th percentile high as a result.

Read More

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities were mixed across asset classes last week as the US government shut down for the first time since 2018. Interest rate volatility declined meaningfully, with the VIXTLT Index falling to a 1-year low while the MOVE Index collapsed to a 3-year low. In contrast, equity volatility gained last week, with the VIX® index increasing 1.4 pts to 16.7%. This is despite realized volatility grinding to a 1-year low of 5.9%. SPX 1M implied-realized spread widened to the 99th percentile high as a result.

- SPX options ended September with a record volume month, averaging 4.26M contracts a day. While 0DTE options remained dominant, comprising 60% of the total volume, the 0DTE share actually fell vs. the previous month as longer-dated options grew at a faster pace. Not only have SPX options grown in absolute volume, but their market share vs. other S&P 500 index-linked derivatives (namely E-mini options and SPY options) have also grown to a record high of 74% (vs. 58% share in 2020). For more on the drivers of this unprecedented growth, see our full report here.

- The bid to single stock vol ahead of earnings continued last week, driving the DSPXSM index to a 5-month high of 34% (highest since April’s Liberation-Day sell-off).

Chart: SPX Options Jump to Record 74% Market Share

Source: Cboe

Source: Cboe

[Download Full Report Here]

[Subscribe Here]