The VIX® Index Decomposition - A Heuristic Framework to Unravel Unexpected Behaviors in the VIX Index

Executive Summary:

- While the VIX index is often referred to as a “fear gauge” – reflecting the fact that it typically moves inversely to the SPX® index – there are times when the two either move together (“spot up, vol up” or “spot down, vol down”) or the VIX index over/under-reacts relative to expectations.

- This decoupling between the VIX index and the SPX index occurs because the VIX index is more accurately a measure of the bid for optionality which is often, but not always, driven by demand for protection. In fact, sometimes the VIX index goes up not due to fear of downside but rather fear of missing out (i.e. increased upside SPX call demand).

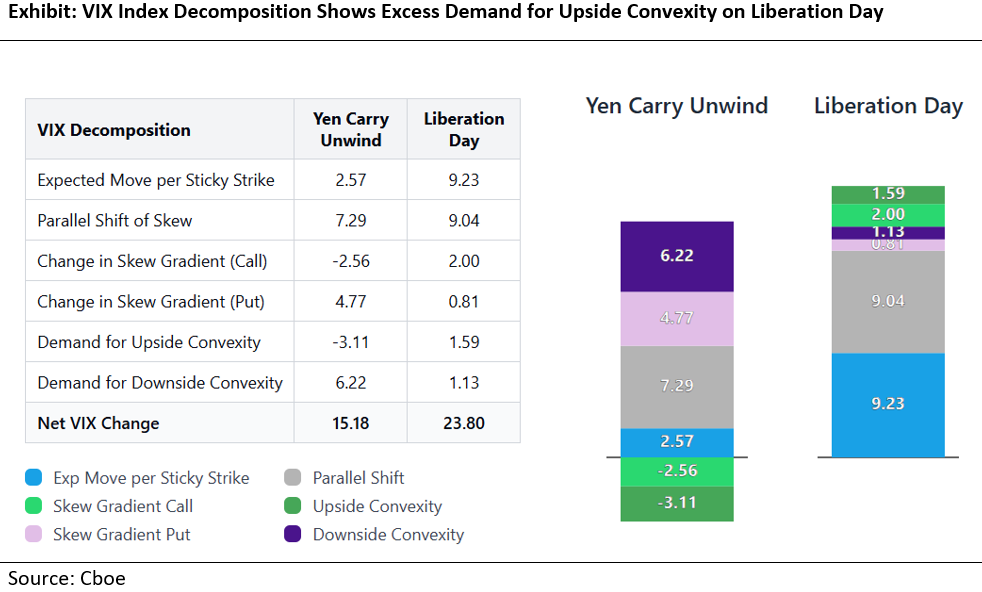

- To bring further clarity into the VIX index behavior, Cboe has developed a heuristic model to disentangle the VIX index move into 6 principal components commonly used by volatility traders to describe changes in the volatility surface, including the “expected” VIX index change, the premia due to the supply and demand for optionality, as well as changes in bearish vs. bullish positioning in the underlying SPX options market

- To demonstrate the usage of our new tool, we include a case study comparing two recent large vol spikes – the Aug 5th 2024 Yen Carry Unwind vs. the April 2025 post-“Liberation Day” sell-off. Our analysis shows that while the VIX index experienced superficially similar nominal moves in response to the tail risk catalyst, they were driven by completely opposite views with respect to investor positioning and sentiment.

- For more, please see full report here. We will also be hosting a webinar on August 14th going over this paper (pre-registration required, please register here). In the coming weeks, we plan on publishing historical decompositions breaking down the largest VIX index moves over the past 25 years and in the Fall, Cboe is planning on launching a web tool that will allow investors to keep track of the decomposition on an ongoing daily basis. To stay abreast of these developments, please subscribe to our mailing list.

[Download Full Report Here]

[Subscribe Here]

Resources

VIX Decomposition Historical Scenarios

VIX Decomposition Webinar Registration

Derivatives Market Intelligence

Access the Full VIX Decomposition Whitepaper Now.