SPX® 0DTE Options Jump to Record 62% Share in August

Mandy Xu

▬

September 2, 2025

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Implied volatilities gained modestly across asset classes last week – albeit from low levels. Gold was the biggest mover, with GLD 1M implied vol gaining over 2.2 pts wk/wk to 16.2% - the only asset class where volatility is trading above its long-term average currently. The jump in GLD implied volatility is especially notable as realized volatility has collapsed to near a 1-year low of 10.4%. Much of the demand for GLD optionality has come from the call side, driving a further inversion in the skew.

- NVDA’s tepid results last week capped a month of Tech underperformance, with the S&P equal-weight index (SPEQX) outperforming SPX index for the first time since March. Notably, while SPEQX realized volatility has fallen relative to SPX, the implied vol spread between the two has widened in recent weeks. Cboe just added PM-settled weekly and month-end options on SPEQX (see more here) for those looking to trade the equal-weight index.

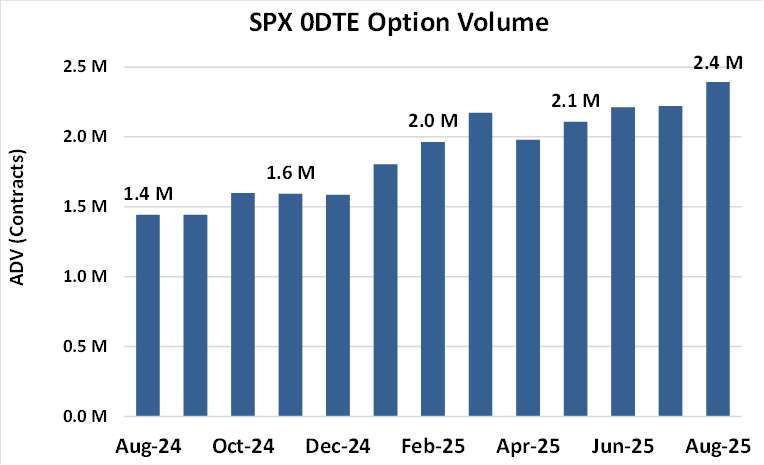

- August was another record month for SPX 0DTE options trading, averaging ~2.4M contracts a day and now making up a record 62.4% of overall SPX volume. The flow remains fairly balanced between retail vs. institutional investors, with retail traders making up an estimated 53% of the volume.

Chart: SPX 0DTE Options Set Another Record in August

Source: Cboe

[Download Full Report Here]

[Subscribe Here]