Record Options Activity Post FOMC Led by Call Buying

Mandy Xu

▬

September 22, 2025

Link to Report: Macro Volatility Digest

WHAT STANDS OUT:

- Interest rate volatility fell to a 1-year low post FOMC last week as consensus built around the rate path, with 2 additional cuts almost fully priced in for the rest of the year. Notably, while bond yields have declined in recent months on hopes of Fed easing, inflation expectations have risen further, with 1Y inflation swaps now trading around 3.3% (vs. 2.5% in Jan). In other words, US real yields have collapsed with bond traders wagering the Fed will look through any inflation uptick and focus entirely on the softening labor market.

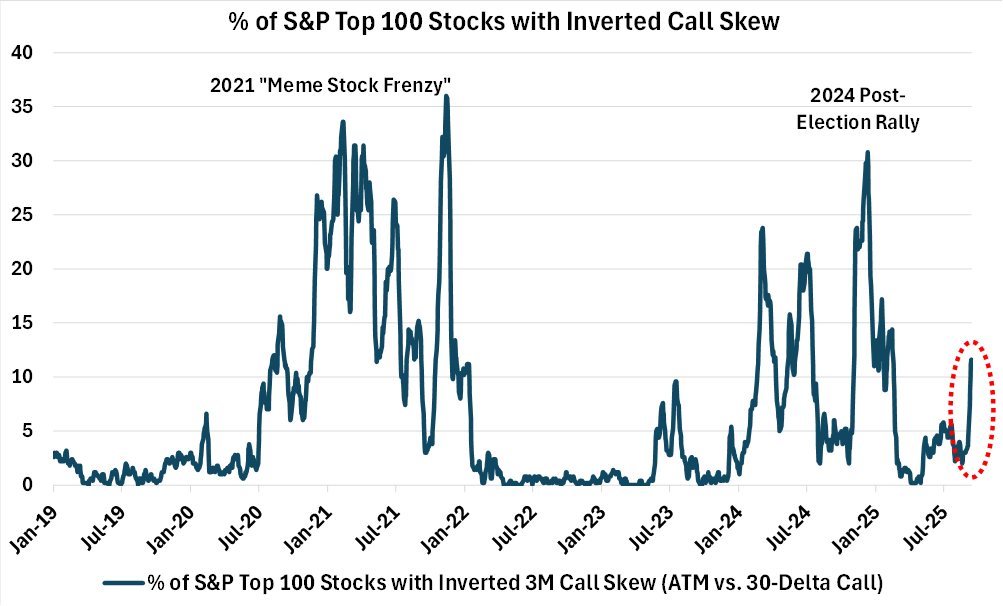

- Demand for optionality increased sharply post-FOMC with single stock option volume hitting a record high of 54M contracts on Friday. Most of the uptick came from the call-side as the equity put/call ratio fell to a 3-months low. The bullish sentiment can also be seen in the number of names trading with inverted call skew (i.e. OTM calls trading at a premium to ATM calls), which is typically a sign of extreme optimism. That number jumped from 3% to 12% over the past week though it still pales to previous episodes of widespread investor euphoria (e.g. 2021 or 4Q24 when that percentage reached a high of 30%).

- At the index level, what’s notable is the surge in bullish activity in the Russell 2000 index, with IWM call volumes hitting an all-time high of 2.85M contracts last Monday (over 5x the number of puts trading).

Chart: Bullish Sentiment in the Options Market Jumped Sharply Last Week

[Download Full Report Here]

[Subscribe Here]