Mandy Xu Email

Trending

A Tale of Two Markets: SPX Options’ Expanding Lead vs. Eminis

Read MoreExecutive Summary:

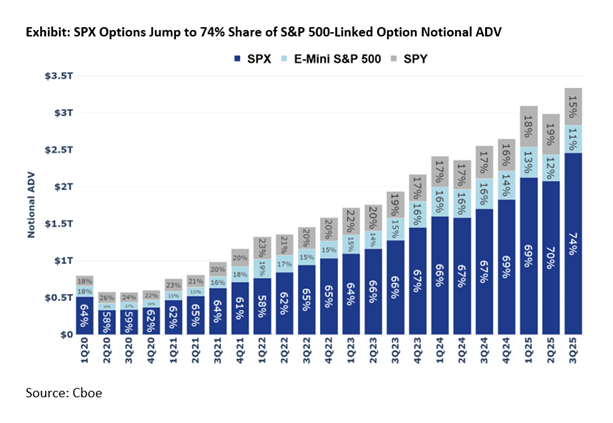

- Over the past 5 years, trading in S&P 500 Index-linked derivatives has accelerated, with total notional ADV across the three most popular products – SPX Index options, SPY ETF options, and E-mini options on futures – surging from $0.5T to $3.3T. During this time, SPX Index options have expanded their dominance, growing their market share from 58% to a record high of 74%. By contrast, both E-mini (ES) options and SPY ETF options have lost market share, now standing at just 11% and 15%, respectively (see chart below). What explains this divergence?

- Capturing the Retail Wave: SPX options have become the clear winner of the post-covid surge in retail options trading, with Cboe’s market structure uniquely positioned to support this trend. In particular, the widening gap in market share reflects SPX options’ dominant position in the 0DTE segment, where it captures 77% of S&P 500 Index-linked 0DTE ADV compared to just under 8% for ES options. Product innovation, contract design, and market structure have compounded SPX options’ edge – and our 0DTE liquidity analysis shows that SPX options hold a clear advantage, with tighter spreads and larger displayed sizes, compared to ES options.

- The Institutional Bedrock: Beneath the growth in 0DTE trading lies SPX options’ enduring institutional strength. Market structure features such as tailored allocation rules, a hybrid trading platform that combines electronic efficiency with open outcry’s capacity to reveal hidden liquidity for large or complex orders, and systematic auction mechanisms that deliver frequent price-improvement have strengthened liquidity in standard 3rd Friday monthly contracts. In these contracts, SPX options generally post tighter spreads and larger size compared to ES options, with the advantages widening further during stress periods such as April 2025.

- The Next Growth Frontier: Global participation has fueled an eight-fold increase in SPX option volume during Global Trading Hours (GTH) since 2020. Analysis shows SPX options liquidity is often stronger and more resilient than assumed, challenging the prevailing view of ES options’ overnight dominance.

- A Self-Reinforcing Liquidity Flywheel: Taken together, these forces sustain a virtuous cycle of: institutional foundation -> product innovation -> retail adoption -> enhanced liquidity -> broader participation -> stronger institutional commitment. This flywheel has firmly established SPX options as the durable benchmark for S&P 500 options exposure, built on a competitive moat of retail accessibility and deep institutional liquidity. For more, see full report here.