Trade VIX Options Nearly 24 Hours a Day

Learn MoreThe VIX Index and Muted Volatility in 2022

Read the article to learn moreMaking Sense of the VIX Index:

An Indicator of Expected Market Volatility

Cboe's Inside Volatility Newsletter brings you the latest insights on the volatility market, breaking news, and interesting trades.

Subscribe to Cboe's Inside Volatility NewsletterVIX® Index Charts & Data

Cboe is the home of volatility trading, and the Cboe Volatility Index® (VIX® Index) is the centerpiece of Cboe's volatility franchise, which includes VIX futures and VIX options.

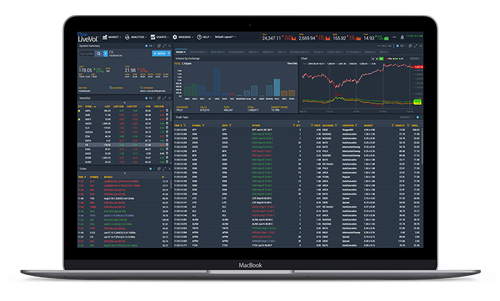

VIX Options Analytics

Get analysis on VIX Options and the rest of the U.S.-listed options market with Cboe LiveVol analytics platforms. LiveVol’s web-based platforms provide everything you need to quickly analyze trading activity and identify opportunities.

View tutorials and take a free trial at LiveVol.com.

VIX® Futures & Options Strategies

VIX futures and options have unique characteristics and behave differently than other financial-based commodity or equity products. Understanding these traits and their implications is important. VIX futures and options may provide market participants with flexibility to hedge a portfolio, employ strategies in an effort to generate returns from relative pricing differences, or express a bullish, bearish or neutral outlook for broad market implied volatility.

Portfolio Hedging

One of the biggest risks to an equity portfolio is a broad market decline. The VIX Index has had a historically strong inverse relationship with the S&P 500® Index. Consequently, a long exposure to volatility may offset an adverse impact of falling stock prices. Market participants should consider the time frame and characteristics associated with VIX futures and options to determine the utility of such a hedge.

Long/Short Volatility

VIX futures provide a pure play on the level of expected volatility. Expressing a long or short sentiment may involve buying or selling VIX futures. Alternatively, VIX options may provide similar means to position a portfolio for potential increases or decreases in anticipated volatility.

Risk Premium Yield

Over long periods, index options have tended to price in slightly more uncertainty than the market ultimately realizes. Specifically, the expected volatility implied by SPX option prices tends to trade at a premium relative to subsequent realized volatility in the S&P 500 Index. Market participants have used VIX futures and options to capitalize on this general difference between expected (implied) and realized (actual) volatility, and other types of volatility arbitrage strategies.

Term Structure Trading

One of the unique properties of volatility – and the VIX Index – is that its level is expected to trend toward a long-term average over time, a property commonly known as "mean-reversion." The mean reverting nature of volatility is a key driver of the shape of the VIX futures term structure and the way it can move in response to changes in perceived risk. CFE lists nine standard (monthly) VIX futures contracts, and six weekly expirations in VIX futures. As such, there is a wide variety of potential calendar spreading opportunities depending on expectations for implied volatility.

Term Structure Data and ChartsThe information above is provided for general education and information purposes only. No statement within these materials should be construed as a recommendation to buy or sell a security or future or to provide investment advice. Supporting documentation for any claims, comparisons, statistics or other technical data in these materials is available by contacting Cboe at cboe.com/contact.

VIX® Index Research

S&P Dow Jones Indices: A Practitioner's Guide to Reading VIX

An easy-to-read guide for understanding the VIX complex. This document provides investors with simple guidelines that translate VIX Index levels into potentially more meaningful predictions or measures of market sentiment.

BlackRock: VIX Your Portfolio

A research paper outlining the opportunities created by using market uncertainty. This paper explains how the strategy of selling volatility has generated higher returns with smaller losses, compared with traditional equity portfolios.

The inclusion of research not conducted or explicitly endorsed by Cboe should not be construed as an endorsement or indication of the value of any research.