Periodic Auctions Book

Execute large orders with minimal market impact through Europe's pioneering auction mechanism that rewards size over speed.

Your Market Advantage

The Periodic Auctions Book provides a reliable place to execute orders within the Cboe EBBO, combining true price formation with an execution model that rewards larger orders. As Europe's pioneering periodic auction mechanism, it delivers the transparency required by MiFID II (in accordance with RTS 1) while protecting your trading intentions.

Key benefits include:

- Price Improvement Opportunities - Trade throughout the spread with EBBO collar protection

- Minimal Market Impact - 4,000x slower than continuous books, prioritizing size over speed

- Built-in Protections - Randomized durations, MAQ safeguards, and real-time surveillance

- Reduced Information Leakage - Only indicative price and size published, not individual orders

- Seamless Integration - Access via sweep orders across multiple Cboe books with one entry

How It Works

Accepted Order Types

- Limit Orders

- Market Orders

- Near, Mid and Far-touch Pegged Orders

- Accept or Cancel Orders

All order types match against any other type. Orders are submitted individually with no paired submission capability.

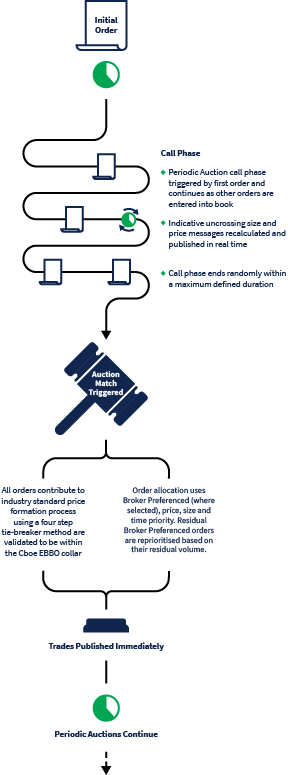

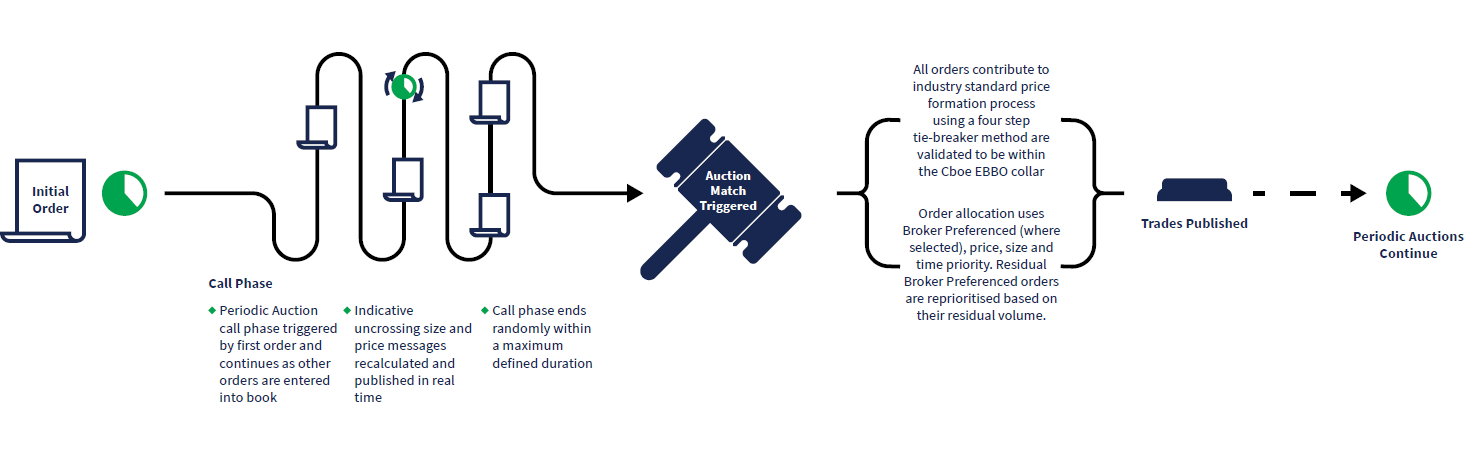

Call Phase

Triggered by first order, continues as orders enter.

- Random end within 100ms maximum duration

- No minimum duration to prevent information fishing

Price Formation

Dynamic pricing using all book orders.

- Four-step tie-breaker: volume, surplus, pressure, reference

- Trades at any price up to limit

- EBBO collar verification (EBBO+1 tick on Cboe NL)

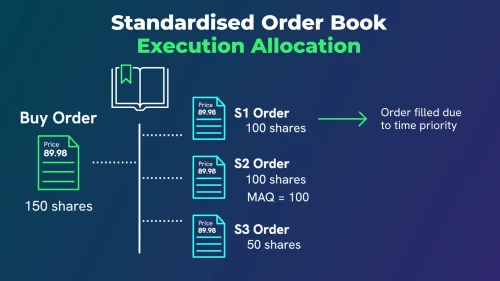

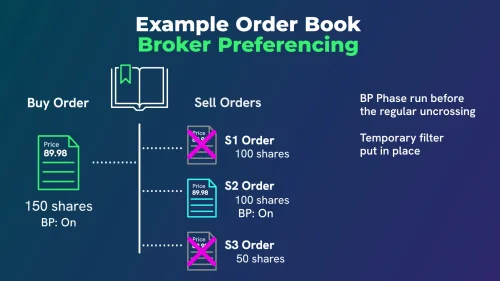

Execution Priority

- Broker Preferenced orders (when selected)

- Price

- Size (larger orders prioritized)

- Time

Transparency Standards

- Pre-trade - Real-time indicative size and price during call phase

- Post-trade - Immediate execution publication per MiFID II

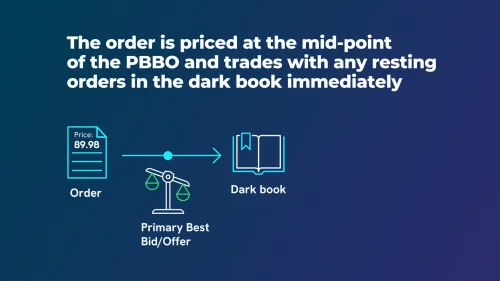

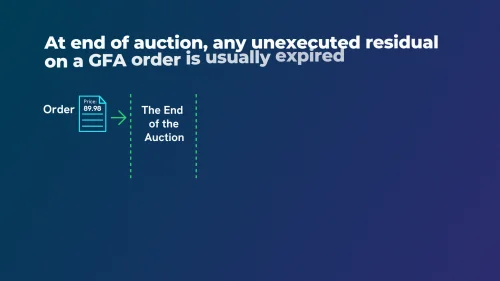

Sweep Orders

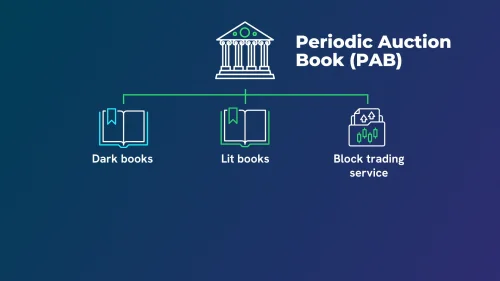

The Periodic Auctions Book (PAB) integrates seamlessly with Cboe's sweep order functionality, allowing you to check for liquidity across our Dark book before accessing PAB, or sweep from PAB to Lit markets—all with a single order entry.

Available sweep types include:- Lit Sweep

- Dark PAB Lit Sweep

- Dark PAB Sweep

- Dark-on Expiry

It's as Easy as a FIX Tag to Participate

Existing Participants connected to BXE and DXE can enter orders into the book by simply using FIX tag 9303=BP. Participants can leverage the same clearing arrangements, connectivity and FIX or BOE ports for order entry for the Periodic Auctions book.

Metrics Behind Matches

We provide transparency into the data behind our Periodic Auctions book by posting statistics for broker priority allocations. The following table shows the percentage of notional executed on Cboe Europe Periodic Auctions which are broker priority allocated.

| Cboe NL | Cboe UK | |

| 2019 | N/A | 22.5% |

| 2020 | N/A | 18.7% |

| 2021 | 18.5% | 18% |

| 2022 | 17.7% | 15.4% |

| 2023 | 15.4% | 13.5% |

| 2024 | 11.4% | 9.8% |

| H1 2025 | 6.3% | 5.7% |

| Q2 2025 | 5.6% | 5.3% |

| Jun-25 | 5.8% | 5.1% |

| Jul-25 | 5.7% | 4.6% |

Explore the Cboe Periodic Auctions Book Video Series

Dive into our expert-led video series to learn how the Book operates, why it matters, and how it’s driving better outcomes for market participants.